May 20: Prime Minister K P Sharma Oli on Tuesday asserted that Lipulekh, Kalapani and Limpiyadhura belong to Nepal and vowed to "reclaim" them from India through political and diplomatic efforts, as his Cabinet endorsed a new political map showing the three areas as Nepalese territory.

Addressing Parliament, Oli said the territories belong to Nepal “but India has made it a disputed area by keeping its Army there”. “Nepalis were blocked from going there after India stationed its Army,” he said.

“India has deployed its troops in Kalapani since 1962 and our rulers in the past hesitated to raise the issue,” he said, asserting, “We will reclaim and get them back.”

The prime minister asserted that the Nepal government will make political and diplomatic efforts to reclaim the territory.

Oli also expressed the hope that India will “follow the path of truth, shown by Satya Meva Jayate, which is mentioned in the Ashoka Chakra, the national symbol of India”.

The prime minister’s remarks came a day after the Cabinet headed by him endorsed a new political map showing Lipulekh, Kalapani and Limpiyadhura under Nepal’s territory.

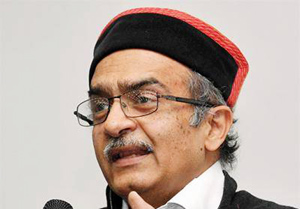

Foreign Minister Pradeep Kumar Gyawali said the official map of Nepal will soon be made public by the Ministry of Land Management. The move announced by Gyawali came weeks after he said that efforts were on to resolve the border issue with India through diplomatic initiatives.

Nepal''s ruling Nepal Communist Party lawmakers have also tabled a special resolution in Parliament demanding return of Kalapani, Limpiyadhura and Lipulekh to Nepal.

The Lipulekh pass is a far western point near Kalapani, a disputed border area between Nepal and India. Both India and Nepal claim Kalapani as an integral part of their territory - India as part of Uttarakhand’s Pithoragarh district and Nepal as part of Dharchula district.

Gyawali last week summoned the Indian Ambassador Vinay Mohan Kwatra and handed over a diplomatic note to him to protest against the construction of a key road connecting the Lipulekh pass with Dharchula in Uttarakhand.

India has said that the recently-inaugurated road section in Pithoragarh district in Uttarakhand lies completely within its territory. Indian Army chief Gen MM Naravane last week said that there were reasons to believe that Nepal objected to India''s newly-inaugurated road linking Lipulekh Pass with Dharchula in Uttarakhand at the behest of "someone else", in an apparent reference to a possible role by China on the matter.

He said there was no dispute whatsoever between India and Nepal in the area and road laid was very much within the Indian side.

The 80-KM-long strategically crucial road at a height of 17,000 KM along the border with China in Uttarakhand was thrown open by Defence Minister Rajnath Singh earlier this month.

Nepal has raised objection to the inauguration of the road, saying the "unilateral act" was against the understanding reached between the two countries on resolving the border issues. China on Tuesday said the Kalapani border issue is between India and Nepal as it hoped that the two neighbours could refrain from "unilateral actions" and properly resolve their disputes through friendly consultations.

After the endorsement of Nepal’s new map senior ruling party leader and member of Nepal Communist Party Standing Committee Ganesh Shah said the new move may escalate unnecessary tension between Nepal and India at a time when the country is fighting the coronavirus.

"The Nepal government should soon start a dialogue with India to resolve the matter through political and diplomatic moves," he said.

The new map includes 335-km land area including Limpiyadhura in the Nepalese territory.

The new map was drawn on the basis of the Sugauli Treaty of 1816 signed between Nepal and then the British India government and other relevant documents, which suggests Limpiyadhura, from where the Kali river originated, is Nepal''s border with India, The Kathmandu Post quoted an official at the Ministry of Land Reform and Management as saying.

India and Nepal are at a row after the Indian side issued a new political map incorporating Kalapani and Lipulekh on its side of the border in October last year.

The tension further escalated after India inaugurated the road link connecting Kailash Mansarovar, a holy pilgrimage site situated at Tibet, China, that passes through the territory belonging to Nepal.

Comments

Add new comment