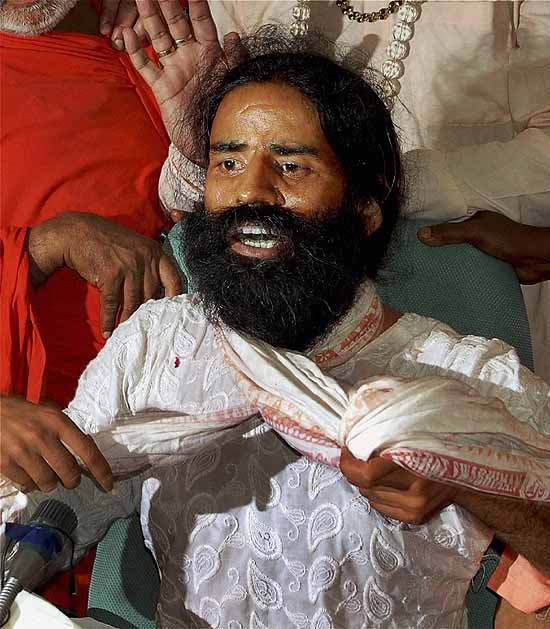

New Delhi, Apr 26: BJP today came out in defence of yoga guru Ramdev over his remarks that Rahul Gandhi goes to dalit for "honeymoon", and said he is a "saint" whose words should be viewed in the context in which they were made and not as per the perception of Congress leaders.

New Delhi, Apr 26: BJP today came out in defence of yoga guru Ramdev over his remarks that Rahul Gandhi goes to dalit for "honeymoon", and said he is a "saint" whose words should be viewed in the context in which they were made and not as per the perception of Congress leaders."Ramdev is a saint. When he selects words like honeymoon, which is an English word, the context should be understood and its usage seen and not be misconstrued..."It did not have the kind of meaning as Congress leaders were viewing it as per their own perception," BJP spokesperson Shahnawaz Hussain said.

Another BJP leader Udit Raj, a dalit, said Ramdev has not said anything "wrong" against dalits and his intention against them was also not "wrong".

"The word honeymoon is viewed in different contexts. There is honeymoon between parties, people and used for the business community. It is also used to say that (Arvind) Kejriwal's honeymoon has ended. It should be seen in this context and no wrong meaning should be construed to Ramdev's words," he said.

Udit said the word honeymoon has a wider meaning and does not have just one meaning but many, and he being a dalit leader would have himself opposed him if Ramdev would have said something wrong.

"The meaning of the word and the intention behind its usage should be viewed in the right context. Ramdev is not of those kind that he would use such words in a bad context. His intention towards dalits is not wrong," he said.

He said by merely eating or sleeping in the houses of dalits does not change their lives as projected by Gandhi.

"Why does Rahul Gandhi not invite dalits to his own house," he said, questioning why Congress has not been able to uplift dalits despite being in power for so long in India.

On the FIR against Ramdev, Udit Raj, who is BJP candidate from North West Delhi, claimed Congress is unnerved at the fact that dalits were supporting BJP.

Asked why BJP was clarifying on Ramdev who was not even a member of the party, he said, "even though this matter is personal, we need to give a clarification as Ramdev has been supporting BJP. That is why it is our duty to support him. So there was a need to clarify from BJP side."

Comments

Add new comment