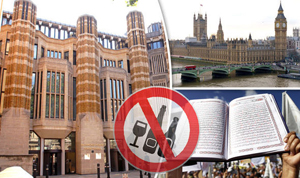

London, Jan 30: British lawmakers may have to comply with the Sharia law including an alcohol ban when they move out of the Westminster Palace which is set to undergo much- needed repairs as the new complex they will shift into is governed by the Islamic law.

A UK parliamentary committee searching for a new temporary home for the House of Commons away from the Palace of Westminster has identified Richmond House, home to the UK's Department of Health, as a favoured option.

But the building in the Whitehall political hub of London was transferred to finance an Islamic bond scheme of "Sukuk" two years ago, and a condition of its lease is that it cannot be used for purposes not sanctioned by Sharia law.

An official told The Times newspaper that under terms of the deal agreed with the UK Treasury, the sale of alcohol is among activities explicitly forbidden.

"It is true. If MPs want to use Richmond House they'd better give up any hopes it will include a bar," he said.

MPs and peers were told this week that they are likely to have to move out of the Palace of Westminster entirely for at least six years to allow for a four-billion pounds overhaul of the crumbling neo-Gothic pile.

According to the newspaper, parliamentarians will have to leave behind at least 10 licensed bars and restaurants, each well-stocked with competitively priced drinks.

The Richmond House complex, just north of the existing parliamentary estate, has been narrowed down as a favoured options as it can easily be taken within a security cordon and could comfortably accommodate a temporary debating chamber.

In July 2014, UK Chancellor George Osborne had announced that the Treasury was launching the first Islamic bond in a western financial centre.

The 200 million pounds bonds, known as Sukuk, would help make Britain "the western hub of Islamic finance" and the "undisputed centre of the global financial system", he said.

The offer was more than 10 times oversubscribed as central banks and sovereign wealth funds in Gulf states snapped up bonds that pay just over two per cent annually for five years.

Devout Muslims cannot buy traditional government bonds because they pay interest.

Sukuk, an Islamic alternative, permit guaranteed returns if they are linked to rental payments.

In the Treasury version, three government buildings — including Richmond House — are being used to finance the products. To ensure that the Sukuk were fully compliant with Sharia, the Treasury agreed to conditions on the properties' use including a ban on the sale of alcohol.

"The committee is looking at a range of options and no final decision has been taken. It is aware that Richmond House is under a bond," a spokesperson for the joint committee on the Palace of Westminster said.

The 182-year-old Palace of Westminster currently has eight bars in its premises.

Comments

UK holidaymakers could make significant financial savings using to locate affordable travel insurance

prices.

Here is my homepage - news broadcast: http://cash099.com/home.php?mod=space&uid=91855&do=profile&from=space

Add new comment