Lucknow , May 13: Samajwadi Party chief Akhilesh Yadav on Wednesday took a jibe at Prime Minister Narendra Modi over announcing Rs 20 lakh crore special economic package to boost the economy saying that the Centre is again making "false promises to 133 crore Indians".

"Earlier, you promised Rs 15 lakh and now Rs 20 lakh crore. You have made false promises 133 times with 133 crore Indians. How can someone trust you this time? People now are not asking how many zeroes there are but how many false promises have been made," he tweeted (translated from Hindi).

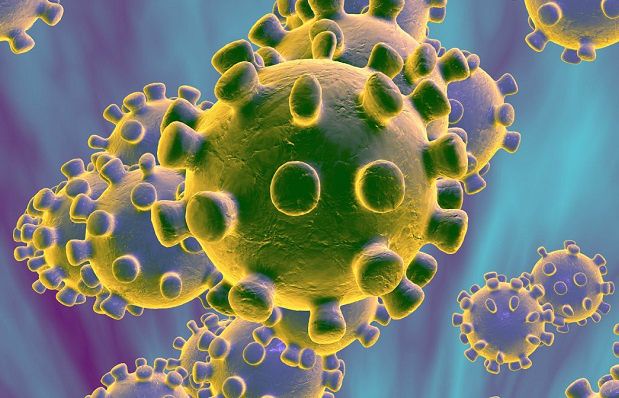

Yesterday, Prime Minister Narendra Modi had announced a Rs 20 lakh crore economic stimulus package for the country fighting COVID-19, stating that it will give a new impetus and a new direction to the self-reliant India campaign.

The Prime Minister had also announced that the fourth phase of lockdown will be completely redesigned with new rules and will commence from May 18.

Comments

Add new comment