Melbourne, Feb 18: Never the one to shy away from a bit of adventurism, Australian spin legend Shane Warne ended up getting bitten on his head by an anaconda during his ongoing stint on a reality TV show here.

According to a report on news.com.au, Warne, while performing a task on the show 'I'm A Celebrity...Get Me Out Of Here!', Warne was bitten by a non-venomous anaconda.

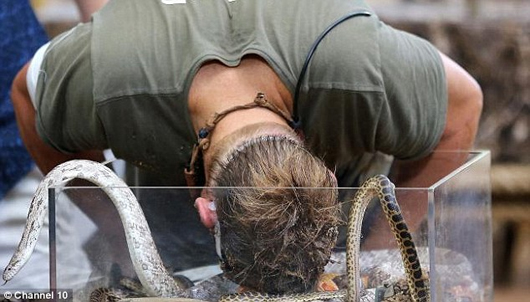

"After bravely facing boxes filled with African clawed frogs, scorpions, Madagascan hissing cockroaches and rats in search of stars, Shane is presented with a box of snakes," the report stated.

"Host Dr Chris Brown warns the legendary spinner that with the scent of rat on his skin, the snakes could easily think he is their next meal. As Shane — who once cried because his daughter would not let him watch the Vince Vaughn comedy Dodgeball - lowers his head into the box, an aggressive anaconda strikes," it added.

Warne was treated for his injury and is being monitored for any sign of infection.

"Shane has made no secret that snakes are one of his greatest fears so it's amazing that after being bitten he bravely continued with the trial," executive producer Stephen Tate told the 'Daily Telegraph'.

"The box contained anacondas, rat snakes and corn snakes. The juvenile anaconda is the one that actually struck Shane. It's non-venomous but very aggressive. Anacondas have 100 rear-facing teeth. Being bitten by one is like getting 100 hypodermic needles at once," a Network Ten spokesperson told 'news.com.au'.

Comments

Anoconda bite is nothing for him. coz he has survived bites of thousands of women during his glorious cricketing career.

Add new comment