Fort Lauderdale, Jan 8: The Iraq war veteran accused of killing five travellers and wounding six others at a busy international airport in Florida has been charged and could face the death penalty if convicted.

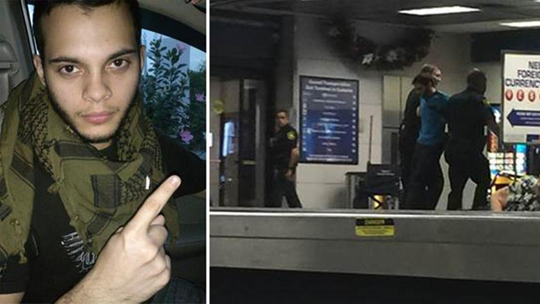

Esteban Santiago, 26, told investigators that he planned the attack, buying a one-way ticket to the Fort Lauderdale airport, a federal complaint said.

Authorities do not know why he chose his target and have not ruled out terrorism.

Santiago was yesterday charged with an act of violence at an international airport resulting in death which carries a maximum punishment of execution and weapons charges.

"Today's charges represent the gravity of the situation and reflect the commitment of federal, state and local law enforcement personnel to continually protect the community and prosecute those who target our residents and visitors," US Attorney Wifredo Ferrer said.

Authorities said during a news conference that they had interviewed roughly 175 people, including a lengthy interrogation with the cooperative suspect, a former National Guard soldier from Alaska.

Flights had resumed at the Fort Lauderdale airport after the bloodshed, though the terminal where the shooting happened remained closed.

Santiago spoke to investigators for several hours after he opened fire with a Walther 9mm semi-automatic handgun that he appears to have legally checked on a flight from Alaska. He had two magazines with him and emptied both of them, firing about 15 rounds, before he was arrested, the complaint said.

"We have not identified any triggers that would have caused this attack. We're pursuing all angles on what prompted him to carry out this horrific attack," FBI Agent George Piro said.

Investigators are combing through social media and other information to determine Santiago's motive, and it's too early to say whether terrorism played a role, Piro said.

In November, Santiago had walked into an FBI field office in Alaska saying the US government was controlling his mind and forcing him to watch Islamic State group videos, authorities said.

"He was a walk-in complaint. This is something that happens at FBI offices around the country every day," FBI agent Marlin Ritzman said.

On that day, Santiago had a loaded magazine on him, but had left a gun in his vehicle, along with his newborn child, authorities said. Officers seized the weapon and local officers took him to get a mental health evaluation. His girlfriend picked up the child.

On December 8, the gun was returned to Santiago. Authorities would not say if it was the same gun used in the airport attack.

Comments

Here , question is , what is the motive behind this killing....there should have one more question, what is the motive of FBI to force him to watch IS videos

US Authrities will now say that he was mentally ill and he did the killings in his absent mind as he was not having any will to kill. However in case he was muslim, US officials wuld have declared him as terrorist having links with ISI, IM, LeT, JDT and so many muslim organisations including some NGOs. US officials would have made long story of the person having travelled to many muslim countries and having contact with various organisations.

Thank God he is Christian.. If it is Muslim they blame as terrorist...

Add new comment