Washington, Jan 31: US President Donald Trump on Monday fired the acting attorney general, a holdover from the Obama administration, after she ordered Justice Department attorneys not to defend his controversial immigration orders.

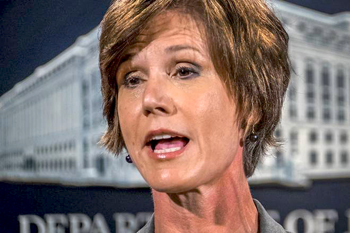

In a sharply worded statement, the White House called Sally Yates "weak on borders and very weak on illegal immigration" and also criticized Democrats for not yet confirming the appointment of attorney general-designate Jeff Sessions.

In a sharply worded statement, the White House called Sally Yates "weak on borders and very weak on illegal immigration" and also criticized Democrats for not yet confirming the appointment of attorney general-designate Jeff Sessions.

"The acting attorney general, Sally Yates, has betrayed the Department of Justice by refusing to enforce a legal order designed to protect the citizens of the United States," the White House said in a statement.

"This order was approved as to form and legality by the Department of Justice Office of Legal Counsel," it said.

"Tonight, President Trump relieved Ms Yates of her duties."

Federal prosecutor Dana Boente will serve as acting attorney general "until Senator Jeff Sessions is finally confirmed by the Senate, where he is being wrongly held up by Democrat senators for strictly political reasons," it said.

With Trump's White House facing multiple lawsuits and worldwide opprobrium over an order banning migrants from seven Muslim nations, Yates had whipped the rug from under her boss in a defiant and damaging parting shot.

In a memo to Department of Justice staff, Yates -- a career government lawyer promoted by Barack Obama -- expressed doubts about the legality and morality of Trump's decree, which has prompted mass protests.

"My responsibility is to ensure that the position of the Department of Justice is not only legally defensible, but is informed by our best view of what the law is," Yates wrote.

"I am not convinced that the defense of the executive order is consistent with these responsibilities nor am I convinced that the executive order is lawful," she added.

"For as long as I am the acting attorney general, the Department of Justice will not present arguments in defense of the executive order, unless and until I become convinced that it is appropriate to do so."

Yates's directive means that the US government, at least for now, has no authorized courtroom representation in the lawsuits.

It was a remarkable act of defiance against a tough-talking president who has showed little sign of brooking insubordination.

Sessions has not yet been confirmed by Congress. He faces a vote on the Senate Judiciary Committee Tuesday and must then be confirmed by the full Senate.

If confirmed, Sessions would almost certainly reverse course.

But Democratic lawmakers have vociferously opposed Trump's order and Republicans are privately seething over the way his White House has handled the issue.

The order signed on Friday suspended the arrival of all refugees for a minimum of 120 days, Syrian refugees indefinitely and bars citizens from Iran, Iraq, Libya, Somalia, Sudan, Syria and Yemen for 90 days.

Several federal judges have since filed temporary stays.

Firing Yates has uncomfortable echoes of President Richard Nixon's "Saturday night massacre" during the Watergate scandal.

Then, Nixon fired the Watergate special prosecutor, prompting the departures of his attorney general and deputy attorney general. The events catalyzed Nixon's impeachment.

On Sunday, attorneys general from 16 US states, including California and New York, condemned Trump's directive as "unconstitutional" and vowed to fight it.

Comments

I hope all western countries ban Muslims forever

This shows the frustration of Trump and hope he will get more frustrations in the days to come for his unwise / illegal decisions which will effect US on all grounds. I hope public anger and disappoint towards Trump will grow day by day.

Add new comment