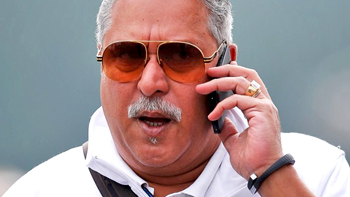

Mumbai/New Delhi/Bengaluru, Mar 8: In a double blow to beleaguered business tycoon Vijay Mallya on Monday, the Enforcement Directorate (ED) in Mumbai lodged a money laundering case and the Debt Recovery Tribunal (DRT) in Bengaluru barred British liquor giant Diageo from paying him anything till a case against him was disposed off.

The tribunal barred Diageo plc from paying Rs 5.04 billion ($75 million) as a severance package to Mallya who quit the chairmanship of its Indian company, United Spirits Ltd. last month, till the pending case against the liquor baron before it is decided.

The tribunal barred Diageo plc from paying Rs 5.04 billion ($75 million) as a severance package to Mallya who quit the chairmanship of its Indian company, United Spirits Ltd. last month, till the pending case against the liquor baron before it is decided.

"The presiding officer of DRT (R. Benkanahalli) ordered temporary attachment of the severance package amount and directed Diageo not to pay it till our case is finally heard and disposed of," counsel for State Bank of India (SBI) told media persons in Bengaluru.

Reading out the one-page order, Benkanahalli said Mallya shall not temporarily draw the $75 million mentioned in the interlocutory application till the case`s disposal.

"Diageo plc and United Spirits Ltd shall not disburse the amount ($75 million) to Mallya or his nominees or agents till the disposal of the bank`s original application (OA). Amount as sought by the applicant banks stands attached," the order said.

The tribunal also directed all defendants to furnish details of the agreement on or before the next date of hearing (March 28), when it will hear the bank`s three other interlocutory applications, seeking his arrest, impounding of his passport and seizure of his assets.

It also ordered issuing notice on the bank`s application to Diageo office in London through registered post.

A consortium of 17 state-run and private banks led by SBI filed the application on February 26, a day after Diageo signed the deal with Mallya for resigning as chairman and not competing with it in the spirits business worldwide for the next five years for $40 million this year and the balance ($35 million) over the next four years.

According to the SBI counsel, Mallya`s now defunct Kingfisher Airline owes the consortium a whopping Rs.10,000 crore, including compound interest over the remaining combined loans of Rs.7,800 crore borrowed between 2004-12 before it was grounded and shut down subsequently.

In another major blow for Mallya, the ED on Monday registered a money-laundering case against him.

"We have filed a case against Mallya on Monday. The case is specifically based on the case registered by the CBI against him and others in (October) 2015," Assistant Director (Enforcement Directorate) A.K. Rawal said in New Delhi.

Mallya and the top executives of the erstwhile KFA have been booked under Sections 3 and 4 of the Prevention of Money Laundering Act (PMLA), Rawal said.

The measure follows an audit of the Rs 7,200 crore loan that the bank consortium had extended to the airline but was not repaid.

The KFA is alleged to have diverted as much as Rs.4,000 crore of that money to international tax havens like Mauritius and Cayman Islands, which is being probed by the ED and the Central Bureau of Investigation (CBI).

Other businesses of Mallya were also being scrutinized by the ED under the PMLA, an official, requesting anonymity, told IANS in Mumbai.

It is feared that Mallya might become a fugitive from law by shifting base to a country where it might be difficult to make him face the Indian laws, officials said.

The flamboyant businessman, who recently announced his plans to spend more time with his family in Britain, has refuted all charges against him and taken exception to being labelled as a "wilful defaulter" by some of the lender banks.

Mallya has also denied he was planning to flee the country and said he was ready to cooperate with the lenders and the agencies to settle the debt.

Though the consortium of lenders moved the tribunal in 2013 for recovery of their outstanding loans, Mallya`s dramatic announcement that he would move to London forced the banks to lay first claim on the deal amount and rush to the tribunal for early hearing of its case.

Perceived as the `King of Good Times`, Mallya was recently in the news when some former airlineemployees wrote an open letter, blaming him for the grounding of the airline and damaging the country`s reputation in the aviation industry.

Once reputed as the most glamorous and luxurious private airline in the country, KFA fell into bad days and was grounded in October 2012 after a huge financial mess, including default of bank loans, dues to oil companies, airports and even staff salaries.

Comments

No matter what, he should not have stopped paying for his employees...it is their curse...that brought him to this stage....

this same SBI bank and other bank need all the document and everything if poor guy have they will not provide even 20,000 of loan, and here mally did wonderful job, dont pay even one rupee to them all this bank eaten poor people's money.

Add new comment