Jeddah, Jan 21: Jeddah will have a smoother traffic flow thanks to the bridges and tunnels projects the mayoralty is implementing with coordination with Jeddah traffic administration, said Zaid Al-Hamzi, spokesman for the Jeddah traffic police.

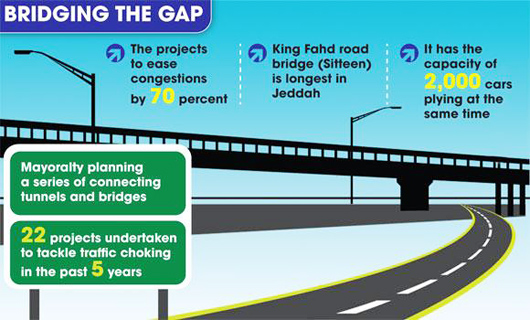

Al-Hamzi said the new projects will facilitate traffic movement and ease congestions by 70 percent.

These remarks came after the inauguration of the King Fahd (Sitteen) Road bridge across Heraa Street (White Horse Square) and Prince Sultan Bin Salman Street. The 2.5-km long and 56 meter wide bridge has a capacity of carrying 2,000 cars at the same time. With three lanes on each way of traffic, it gives the area a 100 percent flexibility and release traffic for Heraa and Prince Sultan Bin Salman streets.

Jeddah Mayor Hani Abu Ras on Sunday opened traffic on the bridge that is considered the longest in Jeddah.

Abu Ras said the mayoralty is keen on easing the traffic jams in Jeddah by implementing a series of connecting tunnels and bridges to release the traffic in the main roads and intersections, “The Jeddah mayoralty has carried out 22 projects for easing traffic congestions in the past five years, including constructing 18 bridges and 10 tunnels,” he added saying that these projects have decreased the commuting time in Jeddah.

The project is the sixth project to be implemented on the Sitteen Street (north-south) as Jeddah celebrated opening the industrial institute intersection bridge, Quraish street intersection bridge, Al-Tahlia intersection, King Abdullah road tunnel, and Gharnata street bridge.

Abu Ras said that citizens and visitors of Jeddah will celebrate the opening of a bridge at the intersection between Madinah Road and Haleema Al-Saadia Street in the upcoming month. He pointed out the King Fahd intersection bridge with Al-Rawda Street (the Bicycle Square). The bridge is a 583-meter-long,13.5-meter-wide and has three lanes for each traffic side.

The mayor added the final designs are being put to King Fahd Road tunnel at the intersection with Al-Falak and Sari streets, adding that the project will be rendered soon. The project is part of releasing traffic congestion project at the King Fahd Road (Sitteen), especially that this important road links between King Abdulaziz International Airport and Jeddah Islamic Port.

Abu Ras said work is under way for seven bridges and tunnels projects, including King Abdulaziz intersection tunnel with Palestine and Al-Hamra streets, King Fahd Road (The bicycle) intersection with Al-Rawda, Prince Majed intersection with Bani Malik road-bridge, Madinah Road and Haleema Al-Saadia intersection bridge, Prince Majed intersection tunnel and bridge with old Makkah Road, Al-Mahjar intersection bridge with Zenel and Television streets, Al-Mahjar intersection bridge with King Faisal Road (The southern Corniche).

Comments

Add new comment