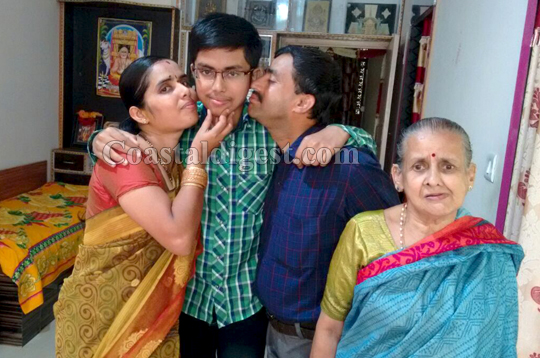

Mangaluru, May 29: Mohan Alva, chairman of Alva's Education Foundation, Mohan Alva, has announced a cash prize money of Rs. 5 lakh for Ananth G, student of Alva's PU College, for topping the medical/dental stream in the Common Entrance Test.

Ananth, who hails from bengaluru, had come to Dakshina Kannada for education. “Coaching in the college, night special classes and support of teachers, parents and Alva's College chairperson helped me to achieve the feat,” he said.

“I used to study for six to seven hours a day. The atmosphere in the hostel was also very conducive for learning. The doubts were cleared by the teachers daily which helped us,” he said.

He also said that he was totally disconnected from TV and mobile phone for the last two years, which helped him to concentrate on his studies.

Explaining his choice of Medicine, Ananth said, “I want to serve the people, so I am choosing a noble profession. I want to pursue my studies in Bangalore Medical College.”

Comments

Excellent performance, all the best.

all the best and keep the good performance in next stage.

Add new comment