Jeddah, Jan 22: Hotels in Saudi Arabia experienced noticeable increases in occupancy rates, with Jeddah increasing by 7.0 percent year-to-date, and Madinah increasing 2.0 percent year-to-date, Ernst and Young Middle East said in its latest Hotel Benchmark Survey.

Jeddah, Jan 22: Hotels in Saudi Arabia experienced noticeable increases in occupancy rates, with Jeddah increasing by 7.0 percent year-to-date, and Madinah increasing 2.0 percent year-to-date, Ernst and Young Middle East said in its latest Hotel Benchmark Survey.

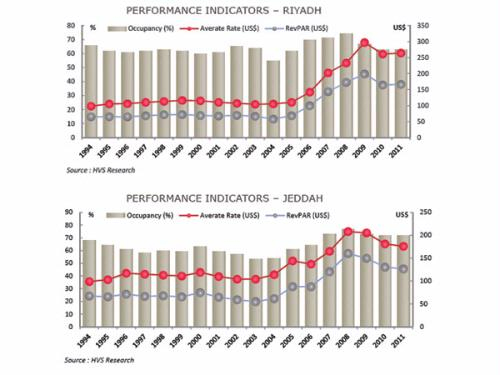

Compared to November 2011, Riyadh’s occupancy rate increased by 17.0 percent in November 2012. This is accredited to the various initiatives undertaken by the city to showcase lost artifacts and the introduction of new cultural experiences to the city.

The report provides a monthly performance overview of leading hotels in the Middle East.

With regard to the wider MENA region, the report saw notable changes in the city of Amman, where overall occupancy rates increased by 16.0 percent year-to-date. The increase may be attributed to the onset of milder climate conditions, in addition to increased political stability which attracts tourists from the neighboring Levant region. The year-to-date room yield in Amman is 31.7 percent higher than it was year-to-date in 2011, with the average room rate 3.1 percent higher than it was year-to-date in 2011.

Commenting on the survey, Yousef Wahbeh, MENA Head of Transaction Real Estate at Ernst & Young, said “the overall occupancy rate in Dubai was at 80 percent year-to-date, rising two per cent from same period of last year. In terms of the monthly performance, Dubai’s overall occupancy rate increased to 90.9 percent, marking a 3.7 percent increase from November 2011.

Additionally, room yield (RevPAR) increased by 10.8 percent year-to-date, with average room rate increasing by 7.5 percent year-to-date.”

Compared to November 2011, rooms yield (RevPAR) increased by 3.8 percent and average room rate marginally decreased by 0.4 percent in November 2012. The increase is attributed to the high number of forums and conferences from the banking & finance sector, securities sector and the oil & gas sector held in Dubai during the month of November. This represents Dubai’s increasing appeal as a business-friendly environment that continues to attract major investments and international projects in addition to the stable and increasing tourism sector within the city.

Bahrain also witnessed positive changes in its hospitality Key Performance Indicators, where the overall occupancy rates increased by 7.0 percent year-to-date. This change is due to several expositions taking place in the Kingdom during the month of November, including the Jewelry Arabia Exhibition, the Oil & Gas Trade Forum and many security talks which included regional heads of state. The year-to-date room yield in Bahrain has increased to 20.7 percent from the 2011, while the average room rate witnessed a mild 0.4 percent drop compared to the same time period last year.

There were no noticeable changes in Egypt, where cities such as Cairo, Sharm El-Sheikh and Hurgada remained stable in their overall occupancy rates, with Cairo’s occupancy rising 7.0 percent year-to-date, Sharm El Shaikh’s occupancy grew 12.0 percent year-to-date, and Hurghada’s occupancy rate grew 8.0 percent year-to-date. Sharm Al Shaikh also witnessed the highest year-to-date growth in Egypt in terms of Rooms Yield, of 16.3 percent compared to the same time period in 2011. In terms of monthly performance, Cairo’s occupancy rate improved 11 percent compared to November 2011, with Sharm El Shaikh increasing 6.0 percent and Hurghada 5.0 percent compared to November 2011.

The improving climate in the UAE and increased political stability in the region are setting up for a successful incline in hotel occupancy, the report added.

Comments

Add new comment