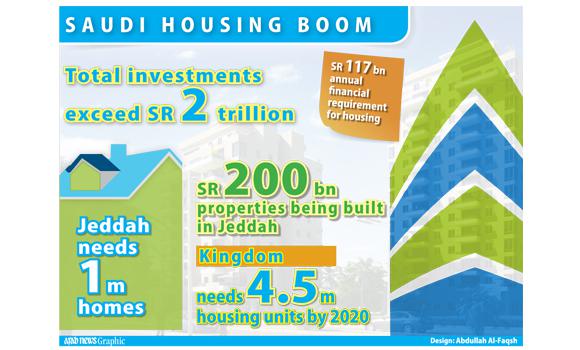

Jeddah, Mar 2: Total investments in real estates across Saudi Arabia have reached more than SR 2 trillion, making the country one of the top real estate markets in the world.

“The Kingdom’s housing need in 2020 is estimated at 4.5 million units at an estimated cost of SR 117 billion annually and it would need 110 million square meters of housing plots,” said Khaled Al-Ghamdi, chairman of Taifah Al-Aqar in Jeddah.

Housing is one of the major problems facing the Kingdom.

Al-Ghamdi put the housing needs of Jeddah at 1 million units by 2020. “There is demand for 100,000 residential units in the city every year,” he said.

Jeddah’s real estate business is growing fast with SR 21.5 billion worth of deals concluded over the past three months. He attributed the increasing investment in the sector in Saudi Arabia and other Gulf countries to the region’s security and stability.

The real estate market in the Kingdom has taken a giant stride in recent years especially in Jeddah where properties under construction are estimated at SR 200 billion. Al-Ghamdi stressed the need to set up a higher commission for real estate without further delay, adding that the Council of Saudi Chambers has recommended its formation. Such a commission, he said, is needed to regulate the Kingdom’s real estate sector and serve as a reference for all its disputes besides serving as a driver for the sector’s increased contributions to the GDP.

Comments

Add new comment