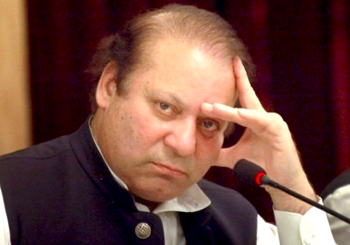

New Delhi, May 24: Congress leader JP Agarwal on Saturday said that Prime Minister-designate Narendra Modi should have asked Pakistan Prime Minister Nawaz Sharif to get Dawood Ibrahim along with him in his oath-taking ceremony.

New Delhi, May 24: Congress leader JP Agarwal on Saturday said that Prime Minister-designate Narendra Modi should have asked Pakistan Prime Minister Nawaz Sharif to get Dawood Ibrahim along with him in his oath-taking ceremony.

"Modi should have asked Nawaz Sharif to get Dawood Ibrahim along, as well as the Pakistani soldiers who beheaded our soldiers. The Bharatiya Janata Party (BJP) was making a lot of noise about the Congress having soft policies regarding Pakistan during their campaign," said Agarwal.

"Now, Modi is wavering from his own stands. He had held completely different views before getting elected. How come there is a sudden change of policies?" he asked.

India has invited leaders of all South Asian countries, including Nawaz Sharif to Modi's oath-taking ceremony scheduled for May 26.

The swearing-in ceremony, to be held at the forecourt of the historic Rashtrapati Bhavan, is likely to be attended by as many as 3,000 guests, the report added.

Comments

Add new comment