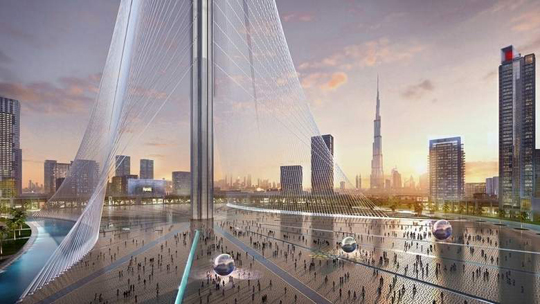

Dubai, Apr 11: Emaar Properties on Sunday unveiled 'The Tower' worth $1 billion in its Dubai Creek Harbour development and the tower will be taller than Burj Khalifa.

Burj Khalifa is the tallest building in the world and its height goes up to 828 metres.

Emaar Properties Chairman Mohamed Alabbar said that the new observation tower would be "a notch" taller than the Burj Khalifa. It is due to open by the time Dubai hosts the World Expo in 2020.

The new mega retail district, which will be launched in 2 months, will be linked to The Tower, Alabbar told reporters.

The chairman said: "The Tower in Dubai Creek Harbour is our tribute to the positivity, energy and optimism that Dubai and the UAE celebrate, led by a leardership committed to all-around progress.

The Tower serves as the vibrant core of Dubai Creek Harbour, a 6 sq. km world-class master planned development that is two times the size of Downtown Dubai and located 10 minutes form the Dubai International airport. The waterfront development is centred off the Dubai Creek, the cradle of Dubai's history and culture, and in close proximity to the Ras Al Khor National Wildlife Sanctuary, protected under the Enesco Ramsar Convention and home to over 67 species of water birds.

The new tower is designed by Spanish-Swiss architect Santiago Calatrava Valls will not be a traditional skyscraper but more of a cable-supported spire containing observation decks, hanging garden and possibly other tourist facilities.

With over 6.79 million sq m of residential space, 11.16 million sq m of retail precincts, 851,000 sq m of commercial property and 22 hotels with 4,400 rooms, Dubai Creek Harbour serves as a strong economic catalyst for Dubai.

.jpg)

.jpg)

.jpg)

Comments

I remember, 1400+ years ago Prophet Muhammad pbuh said : The hour will not be established till the people of desert (the camel shepherds) compete with one another in constructing HIGH BUILDINGS.

Nobody knows when is dooms day except ALLAH. but on being asked on the signs of the last day, The prophet Pbuh mentions \ You shall see the barefoot, naked, penniless shepherds competing in constructing high buildings. The hadith describes people who become RICH all of a sudden and then build NOT for NEED but only in COMPETITION.

We R seeing it in REALITY today... It is a MIRACLE of Prophet of ALLAH and we should PONDER on what Prophet of ALLAH said.

He asked mankind to worship only one God ALLAH and not to associate partners with him. Read QURAN. ALLAH speaks directly to the person who reads it & U will get the message of YOUR LIFE and its solution.

I believe in ALLAH as my LORD ,

Muhammad pbuh as my prophet and

ISLAM as my Deen...

ALLAH knows best."

Mr.Logic

If this is barren Land, why you are in dubai.

U must understand that because of attracting tourist, dubai is feeding you.

No doubt Qiyamah is approaching fast. This is one of the signs as per the Hadees of our beloved Prophet S.A. May Allah save His slaves from the Fitnah and safeguard our imaan forever.

Add new comment