Mumbai, June 16: When a new mother from south Mumbai sought medical help for the significant distortion of her right breast, the term super-bug never crossed her mind. She may, however, be the most telling example of poor infection-control in Indian hospitals and the ensuing threat to patients undergoing surgeries.

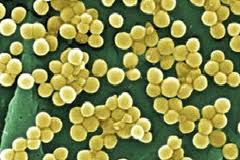

The 30-year-old, who had undergone a breast implant surgery in 2009, was found to be suffering from an MRSA infection. MRSA (Methicillin-resistant Staphylococcus aureus) is one of the most potent superbugs or bacteria resistant to antibiotics. A few years back, the medical journal Lancet carried a series of controversial articles stating that newer superbugs such as NDM-1 (New Delhi Metallo-Beta-Lactamase 1) had emerged from India.

The young mother's right breast was not only more than double the size of the left, it was also lumpy and painful. An evaluation revealed that she first experienced firmness in her breast six months after the surgery, but she thought it was a result of her pregnancy. But the firmness worsened after she delivered her baby and started breast-feeding.

It was only when the doctors did an MRI scan did they realize that there was an infection in the lining (capsule) of the implant. "The MRI scan showed she was suffering from capsular contracture," said Dr Mohan Thomas, consultant cosmetic surgeon at Breach Candy Hospital. "She had undergone the cosmetic surgery in another hospital. By the time she came to us, the capsule (implant lining) of her right breast was about 12mm in size," he said, adding a normal lining does not go beyond 2mm in thickness.

The body reacts to any implant by forming a protective lining around it. This is referred to as the "capsule" or "tissue capsule" and is formed by one's own tissue. In some women, however, the capsule shrinks, squeezing the implant, referred to as capsular contracture. The tighter the capsule becomes, the firmer the breast feels.

It was only after her surgery that the reason for the capsular contracture was found. "While doing the surgery, a large amount of pus and fluid kept oozing out of her breast. We had to remove layers and layers of the capsule. After the surgery, we sent the fluid for examination and it turned out to be MRSA," said Dr Thomas. What surprised doctors was that clinical tests showed no signs of the infection, but only the fluid filled in the capsules showed the presence of the pathogens.

"If this pathogen had spread across the body, it could have killed the person. But in this woman's case, her capsule had taken the whole burden of this pathogen," said Dr Thomas. Worse, he said, she could have passed on the infection to her child since she was breast-feeding. After both her implants were removed, the doctors kept her in hospital until they were satisfied that she was free of infection.

Comments

Add new comment