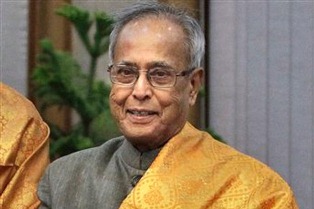

Gadchiroli, July 18: Though the Presidential polls are yet to held, Gondwana University has already described UPA candidate Pranab Mukherjee as "the 14th President of the country" in a just-published textbook.

The book, 'Democracy in India', has been prescribed for first year students of BA (Political Science) for the ongoing academic session of the newly-formed varsity.

Page number 84 under chapter 4 of the book, published under the heading 'Union Executive', has a chart of the Presidents of India in which Pranab has been mentioned as "the 14th President of India".

The book was released a couple of days ago at a function attended by Dean of the Department of Social Sciences of Gondwana University in presence of over 40 lecturers of political science belonging to colleges under the varsity.

Sanjay Gore, Chairman of the Board of Studies of the University and Madhukar Arjunkar, a scholar of political science, are the authors of the book.

University officials were not available for comment.

The Presidential elections, where Pranab will take on BJP-backed nominee PA Sangma, will be held on July 19.

Comments

Add new comment