Mumbai, August 23: Find Bangladeshis, get Rs 2 crore. That was Samajwadi Party (SP) leader Abu Asim Azmi’s singular challenge to Maharashtra Navnirman Sena (MNS) chief Raj Thackeray on Wednesday. While blaming ‘illegal immigrants’ to the city for the August 11 violence at Azad Maidan, Raj had alleged during his rally on Tuesday that Azmi — a Maharashtra MLA — had won the 2009 polls because of the Bangladeshi voters in his constituency.

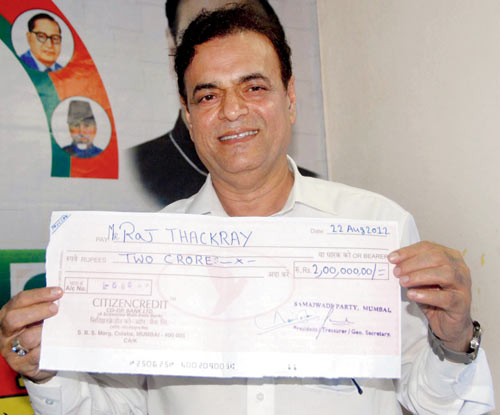

“Raj Thackeray says there are lakhs of Bangladeshis in my constituency. I will give Rs 2 crore if he shows even one lakh Bangladeshis and Pakistanis in Bhiwandi,” Azmi said at a press conference in Mumbai. He even flaunted the Rs 2 crore cheque on the occasion. Bear in mind the cheque has been issued on a Samajwadi Party account.

On Raj Thackeray displaying a purported Bangladeshi passport at the MNS protest, Azmi said, “The throwing of passport should be inquired into. It is a serious offence.”

Where’s the money?

Even as Azmi’s grandstanding was being commended by party leaders, MiD DAY paid a visit to Citizen Credit Co-operative Bank Ltd at Colaba, where the particular account exists. While the manager wasn’t available, another officer informed us that anyone who deposits such a huge amount in an account should confirm the situation with the branch. He also claimed he has never seen Azmi entering the premises.

We then contacted Ganesh Kumar Gupta, the SP treasurer in Maharashtra, to check on the availability of funds. Also, the cheque displayed yesterday had Gupta’s signature along with Azmi’s. But, initially the treasurer appeared oblivious of any such development. In fact he was shocked to hear the amount and the person in whose name the cheque had been written.

“For the last 20 years my party has been in deficit. We do not get any funds except the membership fees. I would have to verify if any large amounts have accumulated in the last two months,” he told this reporter.

Gupta immediately called up Azmi to confirm the facts. Then his tone changed. “Yes, today at the press conference we issued a cheque. The funds do not matter, because we are sure Raj Thackeray won’t be able to prove his allegations.”

While Azmi desires to put up banners pertaining to the cheque at Shivaji Park in Dadar among other parts of Mumbai, Gupta, now extremely excited, went ahead and announced that the reward can go up to Rs 4 crore. “Let him prove that there are illegal immigrants. We will hike the prize to Rs 4 crore. We are certain Raj won’t be able to corroborate anything,” said Gupta.

Azmi speaks

When Azmi realised his party treasurer had told MiD Day too much, he called up this reporter and said, “I am someone whose cheques never bounce. If this cheque bounces, I will quit politics. Also the account has over Rs 1 crore. If needed I can arrange for Rs 3 crore within a day.”

Comments

Add new comment