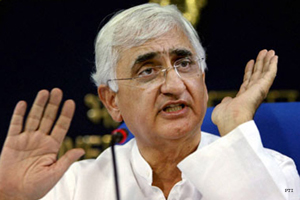

Srinagar, Jun 29: A stable Afghanistan and Iran are critical to India's energy security as these two countries can provide greater access to Central Asian region which has abundance of hydrocarbon wealth, External Affairs Minister Salman Khurshid said today.

Srinagar, Jun 29: A stable Afghanistan and Iran are critical to India's energy security as these two countries can provide greater access to Central Asian region which has abundance of hydrocarbon wealth, External Affairs Minister Salman Khurshid said today.

"We are looking at re-energising the national North-South Corridor to connect India with Central Asia and Russia through Iran, we are looking at trans-Afghan routes using Iranian port of Chahabar particularly to get access to Afghanistan, Uzbekistan and Tajikistan. We are looking at a rail link from Kazakhstan to Turkmenistan into Iran.

"Of course, it does make Iran very critical. On the other hand, it makes Afghanistan very critical. Therefore, we hope that within our philosophical approach of being friends, we get Afghanistan back to a stable situation. Afghanistan will then become a bridge for us to Central Asia and Iran as well," Khurshid said addressing a three-day conference on Central Asia at the Kashmir University here.

The Minister also expressed hope that Iran will be able to resolve its nuclear energy issues with the European Union.

Khurshid said India has been closely watching the development related to the peace process in Afghanistan.

"We have been watching with care and close scrutiny the developments in Doha (Qatar) about the possibility of a conversation and dialogue between the 'willing' Taliban and High Peace Council of Afghanistan.

"We feel and we have said this to our friends, in the US and the European Union, that our collective decision which is very very strongly endorsed in Afghanistan that the peace talks must be Afghan led and Afghan controlled," he said.

Khurshid said although the carbon emissions in India are a fraction of those of the developed world like the US and the European Union, but it will grow "if we continue to rely on conventional forms of energy and we continue to aspire to grow at eight per cent or 10 per cent."

He said the government is working on several things, including a liberalised visa regime with Central Asian countries, to enable "more convenient and liberal access to people on both sides to travel".

On the development partnership with Central Asian countries, Khurshid said India has "done reasonably well in food processing, data processing, renovation and upgradation of hydroelectric power plants, computerisation of post offices and IT centres of excellence in Tajikistan, Turkmenistan, Kyrgyzstan, Uzbekistan and Kazakhstan."

He said India is looking at setting up of Central Asian Universities in near future.

Comments

Add new comment