Mangaluru, May 31: Expressing their anger against Mangaluru City Corporation's decision to install the statue of India's first Prime Minister Jawaharlal Nehru at Nehru Maidan in Mangaluru, the Bharatiya Janata Party (BJP)?corporators, including Deputy Mayor Sumitra Kariya, staged a protest during council meeting on Monday.

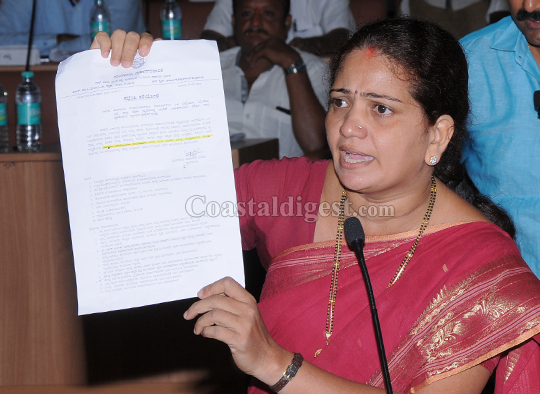

As soon as the meeting started, Opposition Leader Roopa D Bangera said the Congress-ruled council has resolved to instal the statue despite objection by BJP. “I objected to the statue proposal even in a meeting covened by the district in-charge minister recently. But the minister said the BJP is politicising the issue.”

Soon the BJP corporators backed Ms Bangera and started shouting slogans against Mayor Harinath till the end of the meeting. At this point, there was a heated argument between the Congress and BJP members, who also hesitate to call Nehru Maidan by its original name. BJP men normally call Nehru Maidan as Central Maidan' or Kendra Maidan'

Mr. Harinath asked all members to sit down and said that he would give a reply. Enraged with this, the BJP members barged into the well of the House stating that the Mayor was preventing them from speaking in the council and picked up an argument with the Mayor.

Mr. Harinath said that Ms. Bangera threw the letter issued by the commissioner to her on him [Mayor] and he had asked all to sit down and did not show any partiality. The BJP members sought an apology from the Mayor. But he refused.

Later, the agitating corporators staged a dharna at the entrance till the meeting got over and shouted slogans now and then.

Three police personnel who entered the council hall on Monday without the permission of the Mayor were sent back immediately after the members objected to it. They entered the hall along with the BJP members when they barged into the Well of the House for the second time seeking an apology from the Mayor. The police also went to the well of House expecting trouble, sources said.

Comments

if the statue of terror godse will install then bjp and chaddis will be happy....

what a shame to the nation....

What happened to 2500 crore rupees allocated for the statue of Sardar Patel in BJP held Gujrat...... Hope it has not landed in the land of GULUM......

Add new comment