When Prime Minister Narendra Modi won the elections with a sweeping majority in 2014, the whole Internet almost went on a mission to showcase Prime Minister Narendra Modi’s humble background.

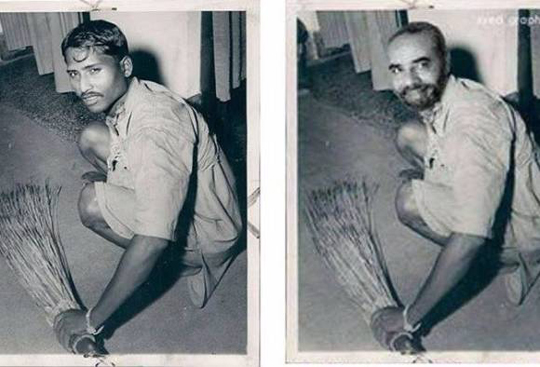

Among many of his photos, a black-and-white photo of Modi holding a broom and cleaning floor had gone viral.

On social media its authenticity was questioned by many but nobody could prove it was fake or real.

But an RTI reply has revealed that the photo was fake and it was photoshopped.

An Ahmedabad-based activist had sought information under the Right to Information (RTI) Act to check the authenticity of the image.

The RTI reply says, “…It is stated while the information sought does not form part of records, it may be noted that the said photograph is morphed and the person in the photo is not Mr Narendra Modi,” reported a news portal, Janta Ka Reporter.

“We all know that Modi saheb spent so much money to win the election. To win the election, his party even used morphed photo and it was widely circulated by andh bhakt (blind supporters) or paid bhakt. That’s precisely what promoted to file an RTI request to cross verify if the photo was genuine,” the same news portal quoted an Ahmedabad-based activist, who had filed RTI, as saying.

And apparently, this is the real image:

Comments

Fake, Fake and Feku.

BJP is well known for fooling the majority of people.

Modi should resign and give the way for real sweeper to become Prime Minister.....

Karma Karma Karma karma. Is there anything real in that person. I doubt whether one who ruling India in the name of Modi is also fake?!

Add new comment