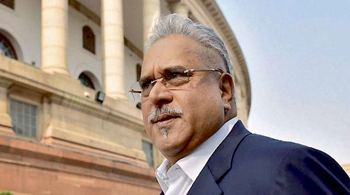

New Delhi, May 4: The Ethics Committee of Rajya Sabha today recommended the expulsion of beleaguered businessman Vijay Mallya.

"The committee was of the firm view that taking into consideration the gravity of the misconduct, a sanction not less than termination of membership from the House is warranted under the circumstances," the Committee on Ethics said in its 10th report tabled in the Upper House by its Chairman Karan Singh today.

"The Committee hopes that by taking such stern action, a message would reach the general publilc that Parliament is committed to take such steps as are necessary against erring Members to uphold the dignity and prestige of this great institution," the report said.

The Upper House will now take a call on the recommendation made by the ethics panel in the report "on the non-disclosure of liabilities such as the loans taken from different banks in his Assets and Liabilities Returns by Dr. Vijay Mallya, Member, Rajya Sabha."

Mallya, in his letter in response to the panel's offer to explain his position, "has raised some legal and constitutional issues which are not tenable, because the Supreme Court has clearly upheld the power of the Rajya Sabha to expel its members for gross misconduct unbecoming of a Member of the House," the report said.

The panel also said "it is a matter of regret that Dr Mallya has thought it fit to impugn the (Supreme Court) judgment and impartiality of the Committee on Ethics as well as the entire House."

Comments

Add new comment