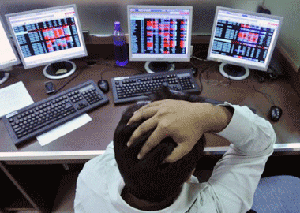

Mumbai, Aug 24: In a stock market bloodbath, benchmark Sensex today crashed over 1,200 points -- biggest in over seven years -- amid a global rout, while more than Rs 3 lakh crore got wiped out of the investors' wealth.

The BSE 30-share index was trading 1,205.7 points down at 26,160.37, while the broader Nifty index of NSE was down 353.35 points at 7,946.60.

The overall investors' wealth, measured in terms of total valuation of all listed stocks, was also down nearly Rs 3.5 lakh crore as it crashed below Rs 100-lakh crore mark and stood at Rs 97,64,237 crore in early afternoon trade.

The loss suffered by the 10 biggest companies in terms of market capitalisation was itself close to Rs 2 lakh crore.

This is the biggest crash in seven and a half years and the third biggest ever for the BSE benchmark index.

Interestingly, eight out of the top-10 intra-day falls took place in the year 2008. Today's fall is biggest since January 21, 2008 when the Sensex crashed by 2,062.2 points.

The market was witnessing all-round heavy selling across realty, power, oil&gas, bankex, auto, metal, capital goods and IT sectors.

The 50-unit Nifty fell below the psychological 8,000-mark, while Sensex was seen moving close to 26,000.

Comments

Add new comment