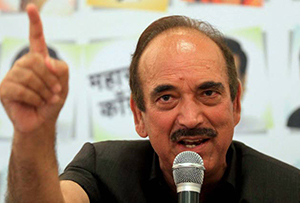

Mumbai, Nov 19: Shiv Sena today came out in support of Congress leader Ghulam Nabi Azad, who is under attack from BJP for drawing a comparison between the Uri terror attack casualties and the deaths after demonetisation, saying an apology by him for the comments will not change the truth.

BJP has sought an apology from Azad, the Leader of Opposition in the Rajya Sabha, for his remarks but he has rejected the demand. "Will the truth change if Azad apologises?" asked an editorial in Sena mouthpiece 'Saamana'.

"In the Uri attack, 20 jawans were martyred. Due to the demonetisation, 40 brave patriots have lost their lives (while standing in queues at banks to exchange demonetised notes).

"The difference is in the attackers. Pakistan attacked us in Uri, where in the case of demonetisation (deaths) it was our own rulers," Sena, a partner of the BJP-led alliance at the Centre, said.

"Even if the number of deaths caused by inflation, recession and unemployment rises from 40 to 40 lakh, this government will say they are victims of patriotism. "We only hope that going by this rate, a time will come wherein we have to declare the entire country as a martyr," Sena said.

Parliament was stalled for the last two days due to ruckus caused by charges and counter charges by the ruling NDA and Opposition over demonetisation. Sena has been unrelenting in its attack on the Centre over demonetisation and had even joined hands with some opposition parties in demonstrations in Delhi over the issue.

Two days back, Union Home Minister Rajnath Singh spoke to Shiv Sena chief Uddhav Thackeray and is believed to have conveyed BJP's unhappiness over NDA ally participating in a march against demonestisation even as the Sena stuck to its criticism, saying it could have been implemented in a better way.

Comments

Rude kid of BJP

Add new comment