Jeddah, April 14: The Kingdom and other new members of G20 should ask for more voting power at key global groupings such as the International Monetary Fund, a top Saudi economic analyst said yesterday as reports emerged that the world's 20 biggest economies are likely to agree to increase the resources of the IMF by between $400 and $500 billion.

G20 finance ministers are set to meet in Washington soon to discuss the IMF's call for more resources from January after the euro zone increased the size of its own crisis-fighting funds in March in response to G20 pressure.

Sami A. Al-Nwaisir, chairman of the board of ALSAMI Holding Group, said G20 members such as Saudi Arabia, Turkey, India, South Africa, etc. "should ask for more voting power and more concessions to better and favorable deal in trade and legal issues."

Al-Nwaisir added: "Once this is clear I think we would look at the world as small village but that notion should start from the people who originated the IMF first then other members of the G20 will follow."

In an exclusive report earlier yesterday, Reuters said the G20 economies are likely to agree to increase the resources between $400 billion and $500 billion, rather than the $600 billion initially sought by the IMF

"It is clear that the global imbalances are among the chief causes and manifestations of the structural problems that gave us the global economic crisis," Jarmo T. Kotilaine, chief economist at the National Commercial Bank, said in his reaction to the new report,

He added: "The IMF has already played an important role in supporting the EU in its efforts to contain the euro zone crisis. But this challenging time for the global economy is far from over and many of the structural weaknesses have proven remarkably persistent, which continues to pose risks for any recovery."

Kotilaine added: "The IMF will need additional resources to play an effective role in the process. Combining its capital increase with a more formal recognition of the changing balance of global economic power makes every sense."

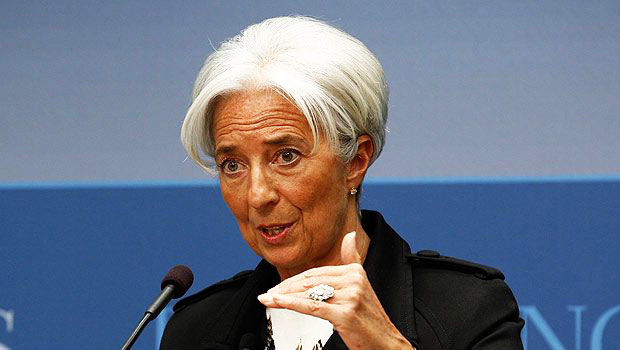

IMF Managing Director Christine Lagarde, quoted by Reuters, said on Thursday that reaching an agreement on additional resources could take some time, a sign that next week's meeting may not be the last word.

Commenting on the latest developments, Al-Nwaisir explained: "The European countries only should increase their contribution. This should happen without asking other members of IMF to bear the expenses of bill that they have nothing to do with, in the first place, as this is a structural problem in the European economy".

He added: "What we are witnessing now is an attempt to raise new funds from new members of G20. I think this is too expensive bill for the new members to swallow while they see double standards in the approach of financial remedies in Europe."

He said the IMF handled almost the same problem in 1997 in a different way than now.

"In 1997, when the Asian crisis happened with Malaysia and other Asian countries the IMF's prescription was different than now with that of the European situation. The IMF asked the Asian countries at that time that they should work harder, change the structure of their economies and improve working habits and place their economies under very tough rules and regulations. The IMF should ask the European countries to take similar measures as they did for the Asian countries in 1997," Al-Nwaisir added.

Comments

Add new comment