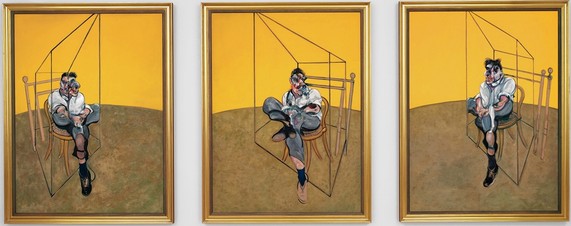

New York, Nov 13: Francis Bacon's three-paneled painting " Three Studies of Lucian Freud" became the most expensive work of art ever sold at auction on Tuesday when it soared to $142.4 million at Christie's.

The 1969 triptych, never before offered at auction and which carried a pre-sale estimate of about $85 million, easily eclipsed the $119.9 million price of Edvard Munch's "The Scream," achieved in May of last year at Sotheby's. The previous record for a Bacon work of art was $86.3 million set in 2008.

The monumental painting depicts the Dublin-born painter's friend and fellow artist Lucian Freud on a chair, with a view from each side and one face-on. Christie's called it "a true masterpiece that marks Bacon and Freud's relationship" and their "creative and emotional kinship."

With bidding starting at a whopping $80 million, it sold after a protracted bidding war both in the packed New York salesroom and via telephone. Christie's did not disclose the identity of the successful buyer.

"Three Studies of Lucian Freud" is also one of only two existing full-length triptychs of Freud, a grandson of the founder of psychoanalysis Sigmund Freud, and the three panels were separated for 15 years in the 1970s before being reunited, Christie's said.

The auction also set another significant record, for a price achieved at auction by any living artist, when Jeff Koons's large sculpture, "Balloon Dog (Orange)," fetched $58.4 million, beating the high pre-sale estimate and smashing the old mark for a living artist of $37.1 million set by Gerhard Richter's "Domplatz, Mailand (Cathedral Square, Milan)" earlier this year.

Auction officials have said that new, deep-pocketed collectors from around the globe are driving prices for top-tier works to record levels.

At a recent preview, Christie's head of postwar and contemporary art, Brett Gorvy, noted that collectors from Asia, Russia and the Mideast flush with cash were determined to assemble world-class collections featuring trophy works.

Comments

Skadze wszystek sposród nas planuje operowac sytuowanie

jednostki w google obok poszczególnego kapitalisci Czyniac w znaczacych firmach niby równiez w nizszych nazwach znacznie nieraz jestesmy

zwodzeni jakze takze zajmowani na jakims Sposród frazeologizmem przedstawiamy ostatniego

któregokolwiek niezwlocznie dostatecznie

Also visit my homepage: pozycjonowanie stron: http://www.bjhomespa.com/comment/html/?1287.html

Add new comment