Denser places, assumed by many to be more conducive to the spread of the coronavirus that causes COVID-19, are not linked to higher infection rates, say researchers.

The study, led by Johns Hopkins University, published in the Journal of the American Planning Association, also found that dense areas were associated with lower COVID-19 death rates.

"These findings suggest that urban planners should continue to practice and advocate for compact places rather than sprawling ones, due to the myriad well-established benefits of the former, including health benefits," says study lead author Shima Hamidi from Johns Hopkins Bloomberg School of Public Health in the US.

For their analysis, the researchers examined SARS-CoV-2 infection rates and COVID-19 death rates in 913 metropolitan counties in the US.

When other factors such as race and education were taken into account, the authors found that county density was not significantly associated with county infection rate.

The findings also showed that denser counties, as compared to more sprawling ones, tended to have lower death rates--possibly because they enjoyed a higher level of development including better health care systems.

On the other hand, the research found that higher coronavirus infection and COVID-19 mortality rates in counties are more related to the larger context of metropolitan size in which counties are located.

Large metropolitan areas with a higher number of counties tightly linked together through economic, social, and commuting relationships are the most vulnerable to the pandemic outbreaks.

According to the researchers, recent polls suggest that many US citizens now consider an exodus from big cities likely, possibly due to the belief that more density equals more infection risk.

Some government officials have posited that urban density is linked to the transmissibility of the virus.

"The fact that density is unrelated to confirmed virus infection rates and inversely related to confirmed COVID-19 death rates is important, unexpected, and profound," said Hamidi.

"It counters a narrative that, absent data and analysis, would challenge the foundation of modern cities and could lead to a population shift from urban centres to suburban and exurban areas," Hamidi added.

The analysis found that after controlling for factors such as metropolitan size, education, race, and age, doubling the activity density was associated with an 11.3 per cent lower death rate.

The authors said that this is possibly due to faster and more widespread adoption of social distancing practices and better quality of health care in areas of denser population.

The researchers concluded that a higher county population, a higher proportion of people age 60 and up, a lower proportion of college-educated people, and a higher proportion of African Americans were all associated with a greater infection rate and mortality rate.

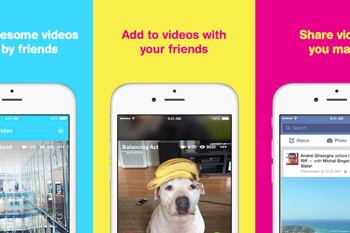

According to the Verge, when users create a Riff video for the first time, they can tag a friend and make it trend. The app is available on both iOS and Android mobile devices. It originated after last year's ALS Ice Bucket Challenge when people began posting videos of them upturning buckets of ice water on their heads in the name of charity.

According to the Verge, when users create a Riff video for the first time, they can tag a friend and make it trend. The app is available on both iOS and Android mobile devices. It originated after last year's ALS Ice Bucket Challenge when people began posting videos of them upturning buckets of ice water on their heads in the name of charity.

Comments

Add new comment