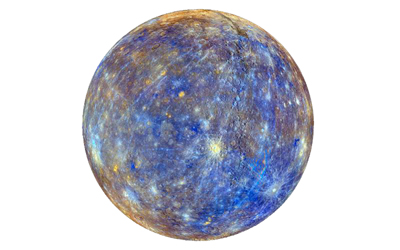

Washington, Nov 17: Scientists have discovered a “great valley” in the southern hemisphere of Mercury, providing more evidence that the small planet closest to the sun is shrinking. Scientists used images from NASA"s Messenger spacecraft to create a high-resolution topographic map that revealed the broad valley — more than 1,000 kilometres long — extending into the Rembrandt basin, one of the largest and youngest impact basins on Mercury.

“Unlike Earth"s Great Rift Valley, Mercury"s great valley is not caused by the pulling apart of lithospheric plates due to plate tectonics; it is the result of the global contraction of a shrinking one-plate planet,” said lead author of the study Tom Watters, senior scientist at the Smithsonian National Air and Space Museum in Washington, DC.

“Unlike Earth"s Great Rift Valley, Mercury"s great valley is not caused by the pulling apart of lithospheric plates due to plate tectonics; it is the result of the global contraction of a shrinking one-plate planet,” said lead author of the study Tom Watters, senior scientist at the Smithsonian National Air and Space Museum in Washington, DC.

About 400 kilometres wide and three kilometres deep, Mercury"s great valley is smaller than Mars" Valles Marineris, but larger than North America"s Grand Canyon and wider and deeper than the Great Rift Valley in East Africa, said the study published in the journal Geophysical Research Letters.

Mercury"s great valley is bound by two large fault scarps / cliff-like landforms that resemble stair steps. The scarps formed as Mercury"s interior cooled and the planet"s shrinking was accommodated by the crustal rocks being pushed together, thrusting them upward along fault lines, the study said.

NASA"s MErcury Surface, Space ENvironment, Geochemistry and Ranging (MESSENGER) mission was launched on August 3, 2004 to understand Mercury, the smallest, densest and least-explored of the terrestrial planets.

Comments

Add new comment