Kanpur/New Delhi, September 2: Against the backdrop of opposition pressure, the fate of 58 coal blocks will be reviewed on Monday at a meeting of an Inter-Ministerial Group (IMG), on whose recommendations wrongful allotments and cases in which mining has not started can be cancelled.

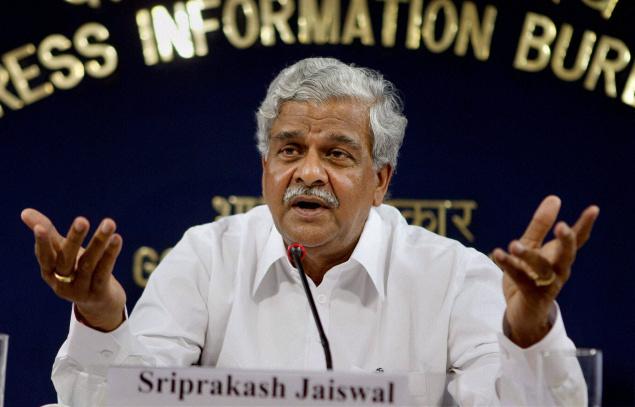

Coal Minister Sriprakash Jaiswal said an IMG has been set up to examine the pros and cons and based on its report any number of allocations can be cancelled.

He said the IMG will give its report by September 15.

"Right now, no allocations are being cancelled. On the basis of the IMG report, the allocations which were made in a wrongful manner or those allottees who have failed to start production of coal in a time-bound manner may face action. Any number of coal blocks can be cancelled," Mr. Jaiswal told reporters in Kanpur.

The government has already issued de-allocation notices to 33 government firms and 25 private entities in this regard. But the opposition has demanded cancellation of all 142 allocations mentioned in the CAG report.

In its report tabled recently in Parliament, the CAG stated that undue benefits to the tune of Rs 1.86 lakh crore were extended to private firms on account of allocation of 57 mines to them.

The IMG comprising representatives from different Ministries may recommend cancellation of such blocks, which did not comply to the development norms.

Sources said the firms in their replies furnished to the Ministry have cited various reasons, including land acquisition problems, delays in forestry and environment clearances and law and order problems for delays in developing the blocks.

The government in April began the process of issuing notices to companies that failed to develop the 58 coal blocks within the stipulated time.

The notices were issued to firms like Reliance Power's Sasan, Tata Power, Hindalco and Grasim Industries, ArcelorMittal, GVK Power, MMTC and others.

In June, the government formed an IMG to review progress of coal blocks allocated to companies for captive use.

Of the total 195 coal blocks allocated to both public and private firms over a decade, only 30 mines have begun production as per the government records.

The government, last year had cancelled the allocation of 14 coal mines and one lignite mine to companies, including NTPC and DVC for failure to develop the blocks.

Comments

Add new comment