New Delhi, Mar 26: The government on Thursday announced a Rs 1.7 lakh crore stimulus that included free foodgrain and cooking gas to poor for three months, and cash doles to women and poor senior citizens as it looked to ease the economic impact of the nationwide lockdown.

While over 80 crore poor ration card holders will each get 5 kg of wheat or rice and one kg of preferred pulses free of cost every month for the next three months, 20.4 crore women having Jan Dhan bank accounts would get one-time cash help of Rs 1,500 spread over three months.

Over 8.3 crore poor women, who were handed out free cooking gas connections since 2016, will get free LPG refills for the next three months, while poor senior citizens, widows and disabled will get an ex-gratia cash of Rs 1,000.

"Since the lockdown has been in force (since Wednesday) and therefore we have come out with a package which will immediately take care of the concerns and welfare of poor and suffering workers and those who need immediate help," Finance Minister Nirmala Sitharaman said at a news conference here.

The package, she said, is being announced within 36 hours of the 21-day nationwide lockdown announced by the Prime Minister to protect the nation's 130 crore people from the fast-spreading coronavirus. "We do not want anyone to remain hungry."

She hinted at more announcements if a need arises.

"So, today's measures are very clearly aimed at reaching out with food and money that they need to have it in their hands. We will obviously think about other things. I will gradually address if there is more to attend," she said.

The package included advancing the payment of one-third of the Rs 6,000 a year pre-2019 general election cash dole scheme for farmers, government contributions to retirement funds for the next three months of small companies with 90 per cent of staff earning less than Rs 15,000, and a Rs 50 lakh insurance cover to healthcare workers.

For rural workers, the daily wage under the MNREGA employment guarantee programme has been increased to Rs 202 from Rs 182, benefiting 5 crore workers of about Rs 2,000 in all.

India joins countries -- from the US to Singapore -- that have pledged spending to contain the economic fallout of the pandemic that has infected almost 5 lakh people globally and left over 21,000 dead.

The pandemic has infected 649 persons in India and has killed 13 so far.

While the free food grains and pulses would cost Rs 45,000 crore, Rs 2,000 payment to 8.7 crore farmers under Pradhan Mantri Garib Kalyan Yojana will cost Rs 16,000 crore.

The cash to women Jan Dhan account holders will cost Rs 31,000 crore and another Rs 13,000 crore is estimated to be the expenditure for providing free cooking gas.

Sitharaman, however, evaded a reply to questions on how the government will finance the package given that the impact of the closure of businesses across the country will be felt over the next few months and would have a direct bearing on already strained tax collections.

She also did not say if the government will relax budget deficit targets or resort to additional borrowings to fund the programme.

The revised fiscal deficit - the gap between revenue and expenditure - has been put at 3.8 per cent of the GDP in the current fiscal. For the fiscal starting April, the government is targeting a 3.5 per cent fiscal deficit.

"Today's measures are very clearly aimed at reaching out to the poor," she said. "At this stage, I am more concerned about reaching out to those who need help."

With businesses closed during the lockdown, the government will contribute employees as well as employer's contribution to the provident fund for the next three months of companies with up to 100 employees with 90 per cent earning not more than Rs 15,000. The contribution will be a total of 24 per cent of eligible wages.

Also, workers will be allowed to draw a non-refundable advance of 75 per cent from credit in provident fund account or three months salary, whichever is lower, she said.

Sitharaman said the limit of collateral-free loans to 63 lakh women self-help groups is being doubled to Rs 20 lakh, impacting 7 crore households.

The free foodgrain and pulses are over-and-above the existing entitlement through the public distribution system (PDS). The ration card holders can take the foodgrain and pulses from the PDS in two installments, she added.

The government had previously relaxed timelines for meeting tax and other statutory filing requirements as well as allowed companies to divert their philanthropy or CSR funds to support the fight against coronavirus.

These measures and the ones announced on Thursday will be topped up by the expected announcement of interest rate cuts by the Reserve Bank of India (RBI) at its bi-monthly monetary policy review meet slated next week.

Commenting on the package, Anil Talreja, Partner, Deloitte India said the announcements are is expected to give reprieve to the mass sections of the population. "This is a good way to ensure that the poor and needy get what they deserve. It has ensured that the farmers, poor senior citizens, widows and specified sections of the society as well as people who are attached to the healthcare sectors get rewarded for their hard work and sacrifices".

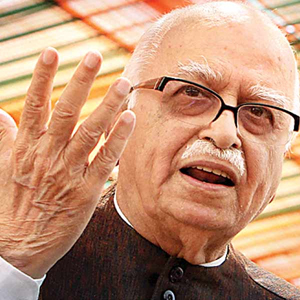

Ahmedabad, Oct 16: Senior BJP leader L K Advani on Wednesday said, "I will be happy if Narendra Modi becomes Prime Minister," indicating that hostilities with the Gujarat CM had been put to rest.

Ahmedabad, Oct 16: Senior BJP leader L K Advani on Wednesday said, "I will be happy if Narendra Modi becomes Prime Minister," indicating that hostilities with the Gujarat CM had been put to rest.

Comments

Add new comment