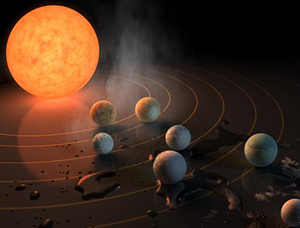

Washington, Feb 23: Astronomers have discovered the first known system of seven Earth-sized planets around a single star - located a mere 40 light years away - that could have liquid water, and possibly host alien life.

Three of these planets are firmly located in the habitable zone, the area around the parent star where a rocky planet is most likely to have liquid water, NASA said.

The discovery sets a new record for greatest number of habitable-zone planets found around a single star outside our solar system.

All of these seven planets could have liquid water - key to life as we know it - under the right atmospheric conditions, but the chances are highest with the three in the habitable zone.

"This discovery could be a significant piece in the puzzle of finding habitable environments, places that are conducive to life," said Thomas Zurbuchen, associate administrator of the NASA's Science Mission Directorate in Washington.

"Answering the question 'are we alone' is a top science priority and finding so many planets like these for the first time in the habitable zone is a remarkable step forward toward that goal," said Zurbuchen.

At about 40 light-years - 235 trillion miles - from Earth, the system of planets is relatively close to us, in the constellation Aquarius. Since they are located outside of our solar system, these planets are scientifically known as exoplanets.

This exoplanet system is called TRAPPIST-1, named for The Transiting Planets and Planetesimals Small Telescope (TRAPPIST) in Chile. In May 2016, researchers using TRAPPIST announced they had discovered three planets in the system.

Assisted by several ground-based telescopes, including the European Southern Observatory's Very Large Telescope and NASA's Spitzer Space Telescope, scientists confirmed the existence of two of these planets and discovered five additional ones, increasing the number of known planets in the system to seven.

Using Spitzer data, the team precisely measured the sizes of the seven planets and developed first estimates of the masses of six of them, allowing their density to be estimated.

Based on their densities, all of the TRAPPIST-1 planets are likely to be rocky. Further observations will not only help determine whether they are rich in water, but also possibly reveal whether any could have liquid water on their surfaces, researchers said.

The mass of the seventh and farthest exoplanet has not yet been estimated – scientists believe it could be an icy, "snowball-like" world, but further observations are needed.

"The seven wonders of TRAPPIST-1 are the first Earth-size planets that have been found orbiting this kind of star," said Michael Gillon, from the University of Liege in Belgium.

"It is also the best target yet for studying the atmospheres of potentially habitable, Earth-size worlds," Gillon said. The study was published in the journal Nature.

Comments

Add new comment