Boston, Apr 5: One of the US' prestigious art museums will hand over to American authorities a rare mid-19th century Tanjore portrait bought from notorious art dealer Subhash Kapoor accused of trafficking stolen antiquities from India.

The Peabody Essex Museum in Massachusetts yesterday announced that it will hand over the Indian artwork to the Department of Homeland Security as part of the government's ongoing investigation into an alleged international art fraud enterprise.

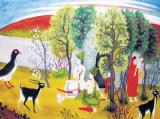

The artwork titled 'Maharaja Serfoji II of Tanjavur and his son Shivaji II' was purchased by the Museum from Kapoor's New York gallery in 2006 for USD 35,000, the Boston Globe reported.

The artwork titled 'Maharaja Serfoji II of Tanjavur and his son Shivaji II' was purchased by the Museum from Kapoor's New York gallery in 2006 for USD 35,000, the Boston Globe reported.

The Peabody Essex is the second US museum to voluntarily agree to relinquish a work of art linked to the dealer.

Earlier this week, the Honolulu Museum of Art returned seven pieces purchased from Kapoor following a probe during which it emerged that the objects had been stolen from temples and ancient Buddhist sites in India and brought to the US illegally.

Kapoor was arrested in 2011 in Germany on charges of trafficking in looted Indian antiquities. He was extradited to India and is awaiting trial. He has pleaded not guilty.

Peabody Essex Museum director Dan L Monroe said the allegations of Kapoor's art trafficking have created "shock waves" around the world.

"It involves a substantial number of art museums, and they're not just in the US," he said, adding that he knew of 18 museums with pieces linked to Kapoor in their collections.

Monroe said the the Museum has been working with Homeland Security Investigations, a division of the federal department, since Kapoor's arrest at the airport in Frankfurt in 2011.

"We took a proactive role to notify the Department of Homeland Security of all works we had through gift or purchase from Kapoor," said Monroe.

Monroe said Kapoor first established his relationship with the Peabody Essex by donating works to the collection.

"He made several gifts to the museum and then eventually offered works for purchase," Monroe said.

He said the Peabody-Essex collection still has "six or seven" of Kapoors works, which federal investigators have told the museum do not appear to have been improperly acquired.

Luis Martinez, a public affairs officer with the Bureau of Immigration and Customs Enforcement, said the investigation known as Operation Hidden Idol has already recovered approximately 1,000 items, worth an estimated USD 150 million, linked to Kapoor, the daily reported.

While some of the works are more recent, many are much older, including a second-century BC pillar sculpture valued at nearly USD 18 million and a 2,000-year-old terra cotta rattle.

"It is the largest seizure that HSI has made from an individual," said Martinez, who added that investigators have identified approximately 2,000 pieces linked to Kapoor that they suspect were looted.

He noted that many of the works are in museums and private collections. "A lot of these museums are victims themselves," he said.

Comments

Add new comment