Jaipur, Jan 20: Author Amish Tripathi, who created waves in Indian publishing with a USD 1 million book contract, has cracked it even bigger this time with an American producer purchasing the rights to "The Immortals Of Meluha."

Jaipur, Jan 20: Author Amish Tripathi, who created waves in Indian publishing with a USD 1 million book contract, has cracked it even bigger this time with an American producer purchasing the rights to "The Immortals Of Meluha."

While Bollywood director Karan Johar has obtained the rights for an adaption of the popular book, the English rights of the same has gone to an undisclosed American producer.

"I have signed the deal with a US producer for the first book with an option for the subsequent books," Tripathi said on sidelines of ongoing Jaipur Literature Festival here.

"I can't disclose the name as of now, it will be announced shortly," the 40-year-old author said.

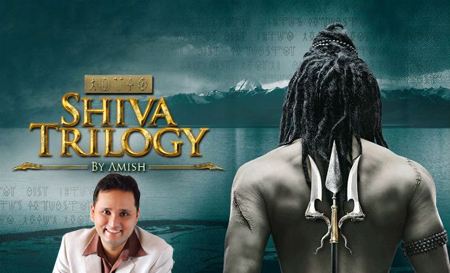

Tripathi was given a lucrative book deal by publisher Westland for writing his Shiva triology "The Immortals of Meluha" (2010), "The Secret of the Nagas" (2011) and "The Oath of the Vayuputras" (2013).

The banker-turned-author has now started work on his next book.

"I have already begun work on my next. It is certainly not an extension to the Shiva trilogy, that's over.

But this book would be also pertaining to mythology, history and spirituality genre. This is my area of passion," he said.

According to Amish, the domestic film industry and publishing industry were moving closer to one another.

Pointing out that during the 50s and the 60s adaptations of books like that by Sharat Chandara, into films was quite common but the practise had died out.

"Now the Indian film industry is changing. The story is gaining importance. The stars themselves want a good story and they have realised that a good story is important and a great place to get those stories is in books," Tripathi said.

Tripathi said filmmakers didn't mind picking a bestseller, which meant that the story was already well liked.

"A bestseller means that the story is out, it is well developed and has been successful already. You know the risk has been reduced," the author said.

Comments

Add new comment