New Delhi, March 8: Bringing with him a rare combination of wit and irreverence, 'Lucknow Boy' Vinod Mehta left his indelible imprint as feisty editor of several successful publications in a career spanning over four decades in which he also shone as a best-selling author and an influential TV commentator.

Known for his candour, 73-year-old Mehta, who breathed his last at AIIMS today, never shied from taking on the high and mighty and giving space to the contrarian voices like that of Booker awardee Arundhati Roy.

It was his refreshingly free of pomposity approach that lent a distinct flavour to the publications he edited beginning from Debonair, from where he started his career as an editor, to Outlook, of which he was the founder editor.

He rendered literary heft to the monthly men's magazine Debonair, better known for its titilating photographs and racy reads, by doing a series of investigative and serious stories.

His success, he recalled in his memoir Lucknow Boy, led him to "serious journalism", his first love, and he founded India's first weekly newspaper, The Sunday Observer.

From there he went on to edit The Indian Post and The Independent in what was then Bombay.

Mehta then moved to Delhi in the early 1990s, when he became Editor-in-Chief of The Pioneer, but his 17-year helmsmanship of Outlook magazine was his longest tenure.

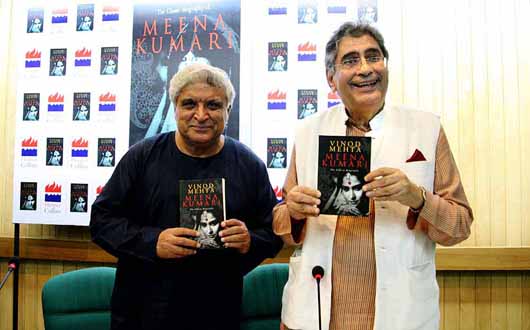

The versatile writer had also written well-acclaimed biographies of film actress Meena Kumari and Congress leader and Indira Gandhi's son Sanjay Gandhi, which was relaunched recently.

Criticised by right-wing voices for his liberal values and denunciation of their at times extremist agenda, Mehta mocked himself as a "pseudo-secular" and wrote about abusive mails he would receive in Outlook, which called him "pro-Sonia, pro-Congress, pro-stray dogs, anti-BJP, anti-Hindutva etc, etc."

He may have his prejudices, he wrote, but he balanced with his professionalism.

"In other words, the basics of my trade impose a discipline which ensures that instinctive or acquired biases are tempered with the simple and clear rules of the profession... Still, I wouldn't claim I am a 100 per cent unbiased editor!," he wrote.

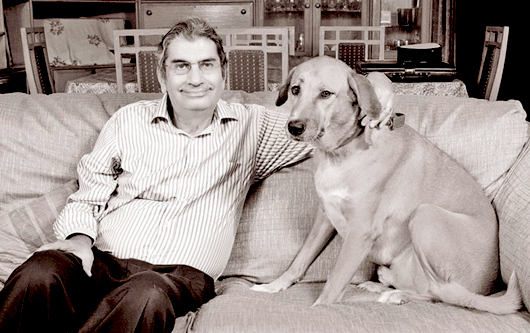

As someone who often made fun of "big egos" of many journalists, it was not without reason that he named his dog 'Editor'.

Comments

Add new comment